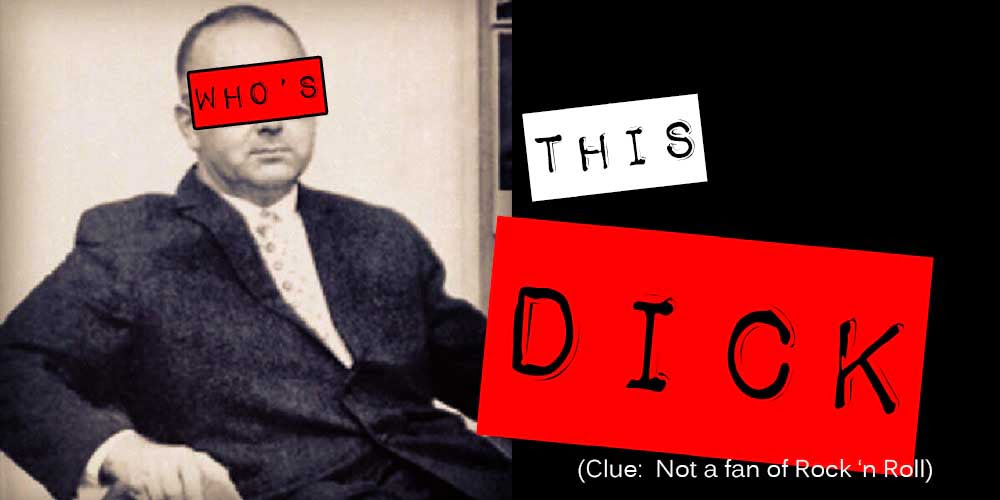

AKA the guy who did not sign The Beatles.

There must be a system

History is littered with stories like this. Walt Disney was rejected more than 100 times. The two Steve’s at Apple Corp. One Steve could design, code and do electronics while the other Steve was an A-hole who was in the right spot at the right time 5 times in a row. Guess which one became an Icon and billionaire? (The other Steve is doing alright.)

On the flip-side there are people in janitorial positions at companies like Micro Soft that had stock options when the company blew up in a spectacular manner. The truth is there is no way of knowing. Nassim Nicholas Taleb writes about this very thing in allot of his books. Black Swan is mainly about capitalizing (or avoiding) things that can in no way be predicted.

Silicon Valley to the Rescue

In the 90s all sorts of strange things started happening in tech and finances, almost none of which I agree with. One positive thing, however, was the way venture capital started to work. Before it was like that A & R guy, Dick, in the 1950s, where they would “audition” companies who already had a winning strategy and then to “mentor” said company to the “next level”. That is certainly not a bad approach. But things started moving just too fast in the early days of the internet. The new approach was to rather invest small amounts of seeding capital in 10 000 tech startups, rather than colossal amounts of funding in a few companies. The hope is; and the odds are, that one in 10 000 will blow up to be the next Google, Uber or Netflix. VCs are basically betting that 9 999 of the tech startups will fail. None of the startups are betting that they will fail and there in lies the paradox of Dick Rowe.

Moral of the story?

Don’t be a Dick (sorry, I could not resist) Rowe. Put aside time each week to score some free coffee, but don’t be a snob. Listen to ideas and try to connect people. One day someone might do the same for you. Have an open mind and go forth to be an entrepreneur. Just don’t tell your mom too soon 😉